Overview

If you choose Original Medicare (Parts A and B) instead of Medicare Advantage, you can get extra help with a Medicare Supplement plan or “Medigap insurance” to cover healthcare costs that Original Medicare doesn’t pay for.

Unlike Medicare Advantage plans, Medigap plans offer additional coverage to reduce out-of-pocket expenses not covered by Original Medicare.

Benefits include:

- Coverage outside of the United States (international travel)

- Partial coverage for part A and B coinsurance/out-of-pocket costs

- Access to more doctors

Understanding Medigap Plans

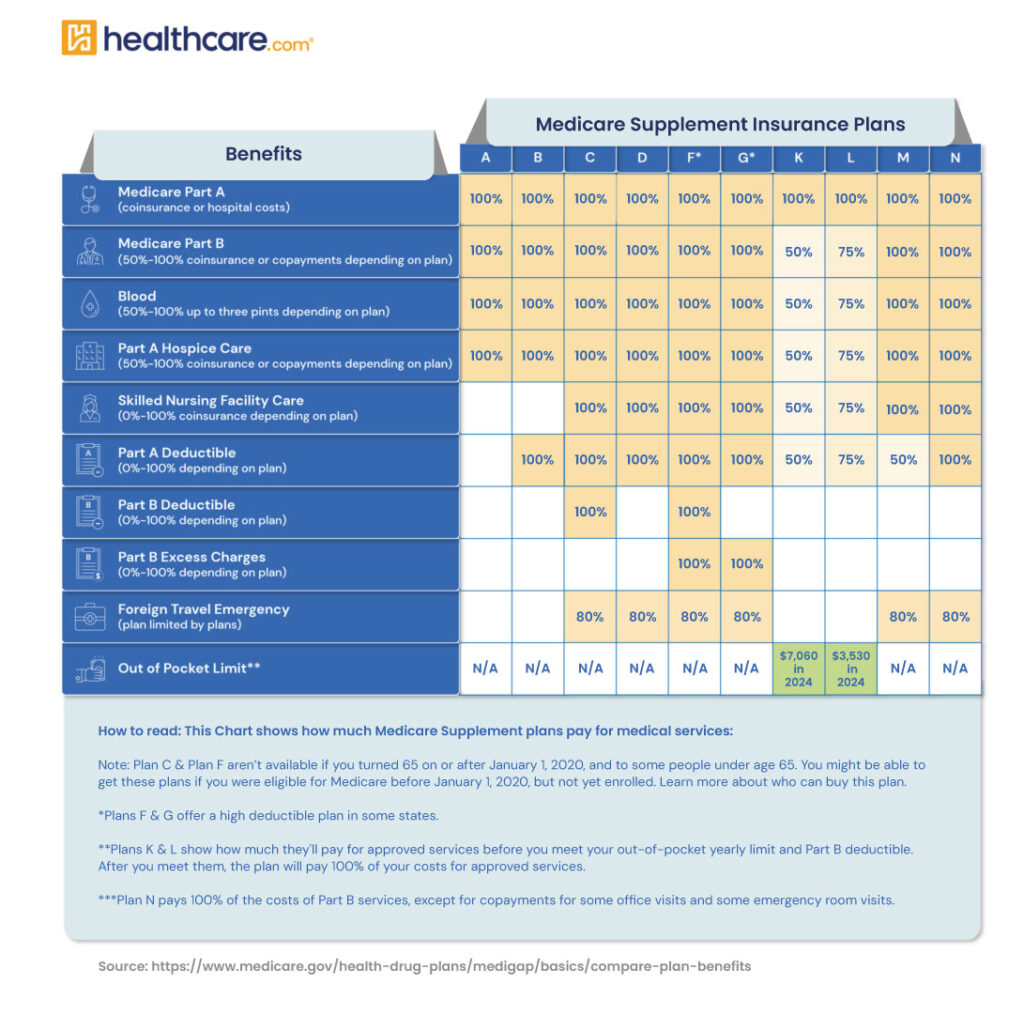

There are lots of plans out there, labeled A, B, C, D, F, G, K, L, M, and N. These plans can cover things like hospital costs, coinsurance, copayments, blood expenses, hospice care, skilled nursing, and more.

Enrollment

You can enroll in a Medigap plan during your initial 7-month Medigap Open Enrollment Period without facing penalties or undergoing medical underwriting. After signing up for Original Medicare, use Healthcare.com’s plan selector to compare and choose the best Medigap plan for your needs.

Plan Costs to Expect

As for the cost, it depends on the plan you choose and what the insurance company charges. For example, Medicare Plan G can cost between $100 to $300 a month on average, but the price can change based on where you live, your gender, and your age.

Next Steps

It’s important to think about what you might have to pay out-of-pocket if Medicare doesn’t cover something. Most Medicare Supplement plans help with Part B coinsurance, and some plans cover many benefits completely, so you might not have to pay extra for Part B expenses.