But our Millennial Health Insurance Survey shows how America’s largest generation is reshaping healthcare.

One-half of Millennials say they’ve experienced a surprise medical bill, and one-third a mistaken bill.

But over three in 10 pay under $100 in monthly premiums.

And over one-half say their health insurance options are very or somewhat affordable.

From telehealth to discount pharmacy apps, Millennials are utilizing healthcare in new ways.

Scroll down for the full results of HealthCare.com’s Millennial Health Insurance Survey 2022.

HealthCare.com Millennial Health Insurance Survey 2022

Key Findings

One-half of Millennials experience surprise medical bills, and one-third mistaken bills.

One in three Millennials experienced unmet healthcare needs due to the COVID-19 pandemic.

Three in 10 Millennials pay under $100 in monthly premiums.

One in four Millennials seek mental health services via telehealth platforms.

Nearly one-half of Millennials, some 36 million Americans, have experienced a surprise medical bill, and over one-third have received a mistaken medical bill.

HealthCare.com surveyed over 1,000 Millennials to assess their experiences with health insurance and better understand how they utilize the healthcare system.

As the U.S.’s largest generation, Americans born from 1981 to 1996 are reshaping the nation’s healthcare delivery and the way we pay for medical treatments.

Roadblocks paying for care

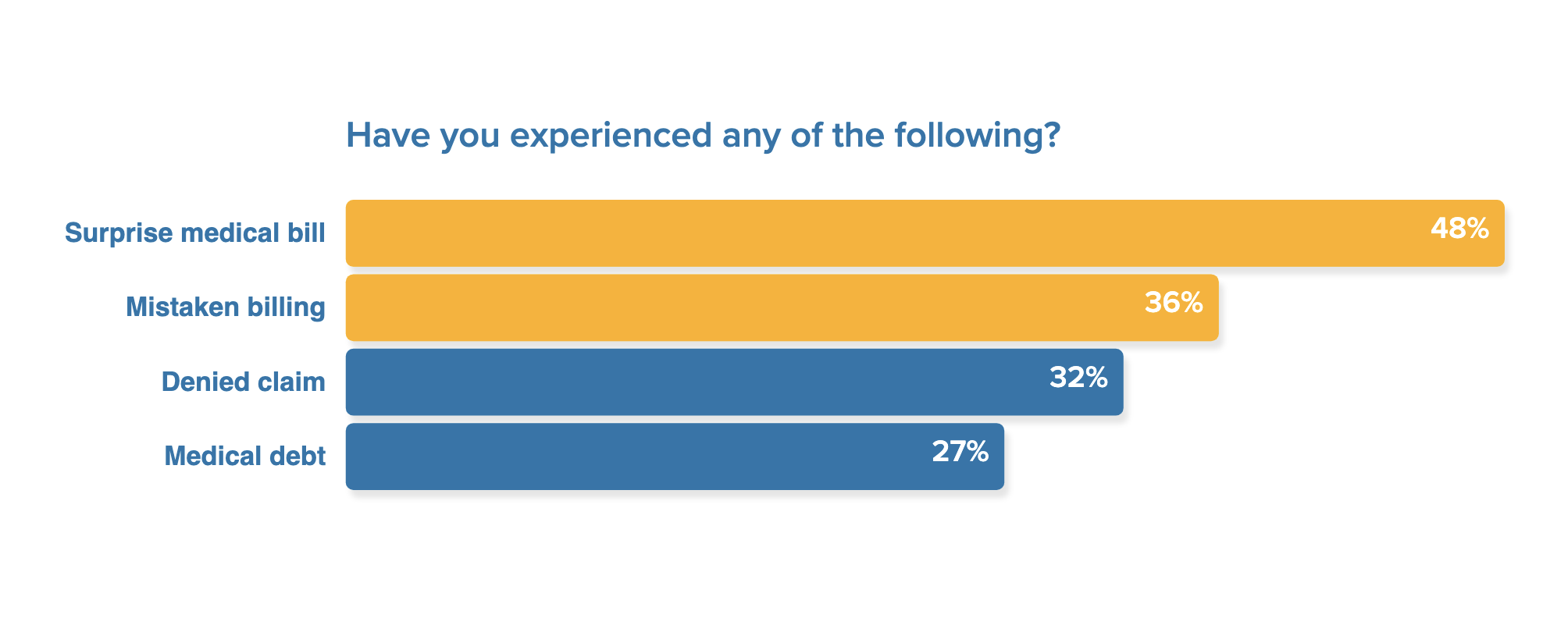

48% of Millennials say they have experienced a surprise medical bill. Many (36%) have experienced a mistaken billing statement, such as a medical coding error. 32% say they’ve had a claim denied, and 27% report medical debt.

These challenges may be a contributing factor in why many Millennials are unsatisfied with their health insurance options.

39% say they are very or somewhat unsatisfied with their health insurance options.

Fewer (28%) say they are neither satisfied nor dissatisfied with their options. One-third (33%) are somewhat or very satisfied with their options.

Among Millennials, the majority (91%) say they have health insurance, while 8% do not. That’s in line with national figures that show 9% of the population lacking health insurance.

Millennials who do have health insurance are most likely to get it through their employer (61%), though some get it from Medicaid (14%) or Medicare (7%).

About one in 14 insured Millennials buys their insurance through a federal or state marketplace, and 7% purchase it independently from a private health insurance company.

An increasing number of Americans are turning to freelance work, including many Millennials. Among Millennials who are self-employed, 39% get their health insurance through a government program like Medicare or Medicaid.

About half as many are enrolled in health insurance on a state or federal marketplace (19%) or get coverage through their spouse’s health insurance (19%).

Fewer (8%) self-employed Millennials are insured in some other way, such as through a sharing ministry or short-term programs. About one in seven (15%) self-employed Millennials do not have health insurance.

Majority call health insurance affordable

A slight majority (54%) of Millennials say the health insurance options available to them are somewhat or very affordable.

35% are paying less than $100 in monthly premiums. About one in five (19%) pay between $100 and $199, and 14% pay between $200 and $299 each month.

At the same time, Millennials have mixed feelings about the cost of plans. While 64% say cost isn’t preventing them from obtaining health insurance, 29% say the opposite–that cost is preventing them from getting covered.

Over one-half of respondents (57%) say they’ve skipped paying for certain goods and services to afford healthcare. Among the forgone services are:

- travel (29%)

- big-ticket purchases (26%)

- entertainment (22%)

- home repair (22%)

- healthcare (17%)

- food (16%)

- Christmas presents (13%)

A plurality (37%) of Millennials say that the monthly premiums were the most important factor when it came to selecting a health insurance plan.

In a positive sign, about one-third (34%) of Millennials say they have a Health Savings Account, a tax-advantaged account to pay for medical expenses.

Millennials transforming healthcare usage via urgent care and telehealth

About half (48%) of Millennials say they’ve used the services of an urgent care center in the past. Many (35%) have turned to telehealth services for physical ailments, while 26% have sought mental health services via telehealth platforms.

27% have used discount pharmacy apps, and 18% have turned to alternative medicine. About one in 11 (9%) say they’ve traveled abroad for healthcare.

Unmet health needs amid the pandemic

The COVID-19 pandemic has affected nearly every aspect of daily life, including interruptions to health services for many people, including Millennials.

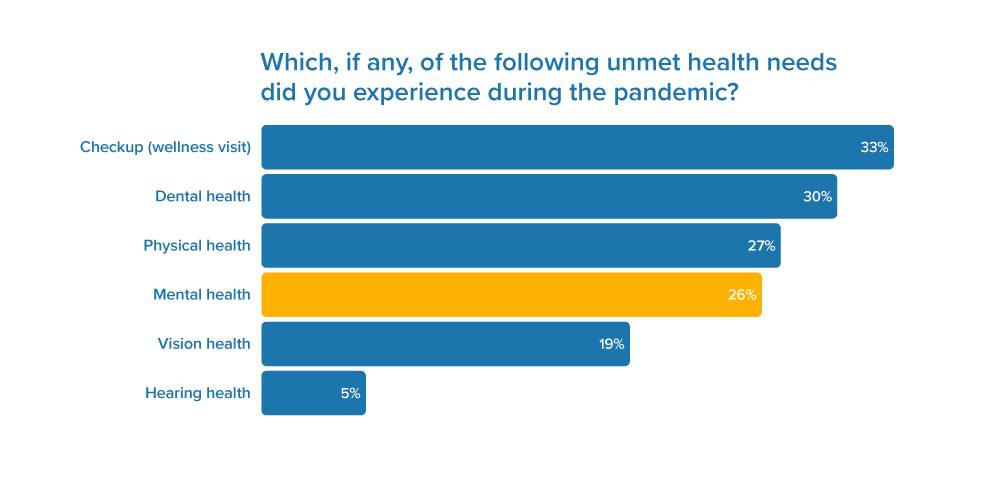

36% of Millennials say they experienced unmet healthcare needs because of the pandemic.

33% say they skipped a checkup or wellness visit, while 30% say their dental care needs went unmet. About one-quarter (26%) say their mental health needs went unmet, and 27% had physical health needs that were not met because of the pandemic.

Methodology

HealthCare.com conducted this survey on February 16, 2022, utilizing a SurveyMonkey Audience to poll a national sample of 1,101 U.S. adults born from 1981 to 1996. The margin of error for this survey is plus or minus 3 percentage points. The sample was balanced for gender, and U.S. region according to the Census Bureau’s American Community Survey.