Understanding the difference between in-network and out-of-network dentists can lead to significant savings in dental care. Here’s some tips:

- Ask the Right Question: Instead of asking, “Do you take this insurance?” when making an appointment, ask, Is this Dentist in-network with my dental insurance company?” The difference is crucial for cost savings.

Each doctor is enrolled individually, not the dental office as a collective. Dentists at certain practices are usually in the same network, but things can shake up when they move to new practices.

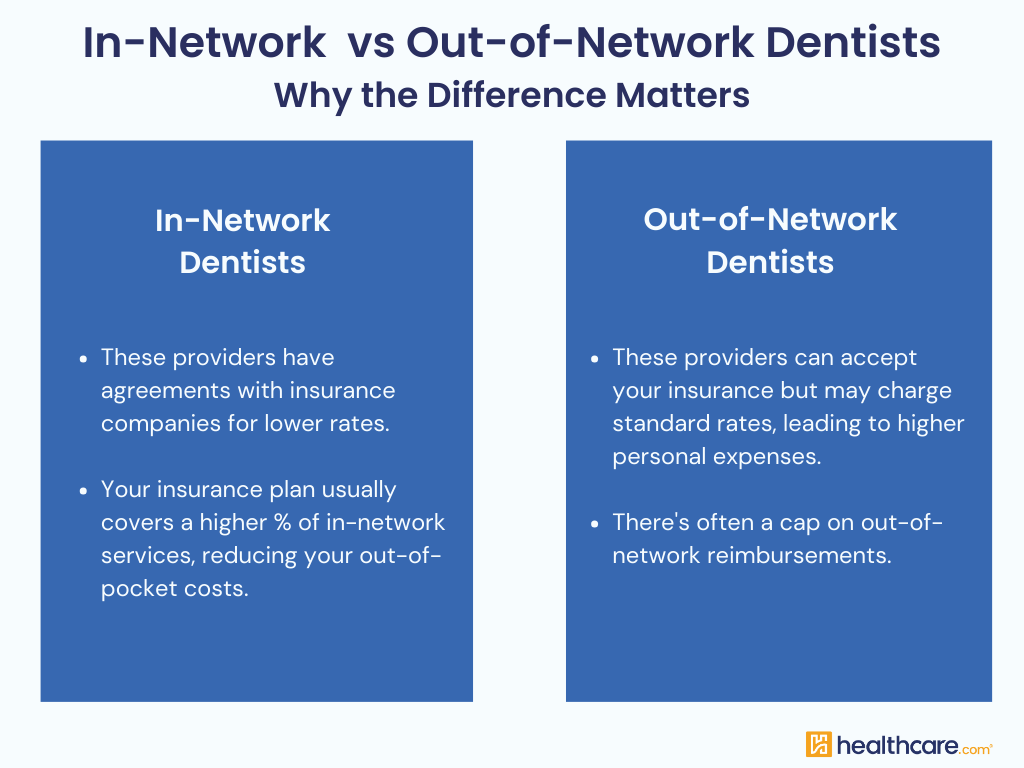

In-Network vs Out-of-Network:

In-Network: These dentists have agreements with insurance companies for lower rates. Your insurance plan usually covers a higher percentage of in-network services, reducing your out-of-pocket costs.

Out-of-Network: These providers can accept your insurance but may charge standard rates, leading to higher personal expenses. There’s often a cap on out-of-network reimbursements.

Jonathan Jones from New York City shares his experience: “A regular check-up with my dentist, who ‘took my insurance’ but wasn’t in-network, used up all of my dental insurance benefits for routine check-ups, not even procedures for me and my family.”

Confused about Health Insurance terminology? Explore our glossary guide.

Quick Reminder:

- Dental insurance is a type of health insurance designed to pay a portion of the costs associated with dental care. It typically covers routine check-ups, cleanings, x-rays, and sometimes a percentage of more extensive procedures like root canals or orthodontics.

- Dental coverage comes in two forms:

- Combined health and dental plans:

- Some Marketplace health plans include dental coverage, with a single premium covering both.

- Separate dental plans:

- Also available in the Marketplace, these require an additional premium on top of your health plan.

- Combined health and dental plans:

Howard Yeh, co-founder of Healthcare.com, adds, “The time and effort for finding an in-network dentist can save some financial stress. Understand your dental insurance coverage, including limits and caps for both in-network and out-of-network services.”

Key Takeaway: Verify if a dentist is in-network with your insurance to avoid unexpected high costs and maximize dental benefits.