HealthCare.com’s new survey shows medical debt is inescapable for many Americans.

Snippet Render Is Present – D3 cannot be loaded in editor mode. Go to preview or publish mode.

Over one in three Americans aged 18 and over carries medical debt.

Over six in ten adults with medical debt received healthcare knowing it would put them in debt.

For over half, the amount of debt was over $1,000.

Many Americans are being driven into medical debt despite having health insurance.

Accidents/injuries are the top driver of debt.

Two in ten U.S. adults with medical debt skip food due to their debt.

Almost half of Americans with medical debt tried to negotiate.

Scroll down for survey details.

HealthCare.com Medical Debt Survey 2021

Key Findings

35% of Americans aged 18 and over carry medical debt.

62% of American adults with medical debt received healthcare knowing it would put them in debt.

For 52%, the amount of debt was over $1,000.

22% of U.S. adults with medical debts skip food due to medical debt.

Over six in ten American adults with medical debt received healthcare services knowing it would put them in debt.

HealthCare.com’s new survey shows that 35% of Americans aged 18 and over carry medical debt.

Among that group, 62% knew they would go into debt when they received healthcare.

For over half (52%), the debt surpassed $1,000, and for 14% of respondents the sum exceeded $5,000.

Causes of Debt

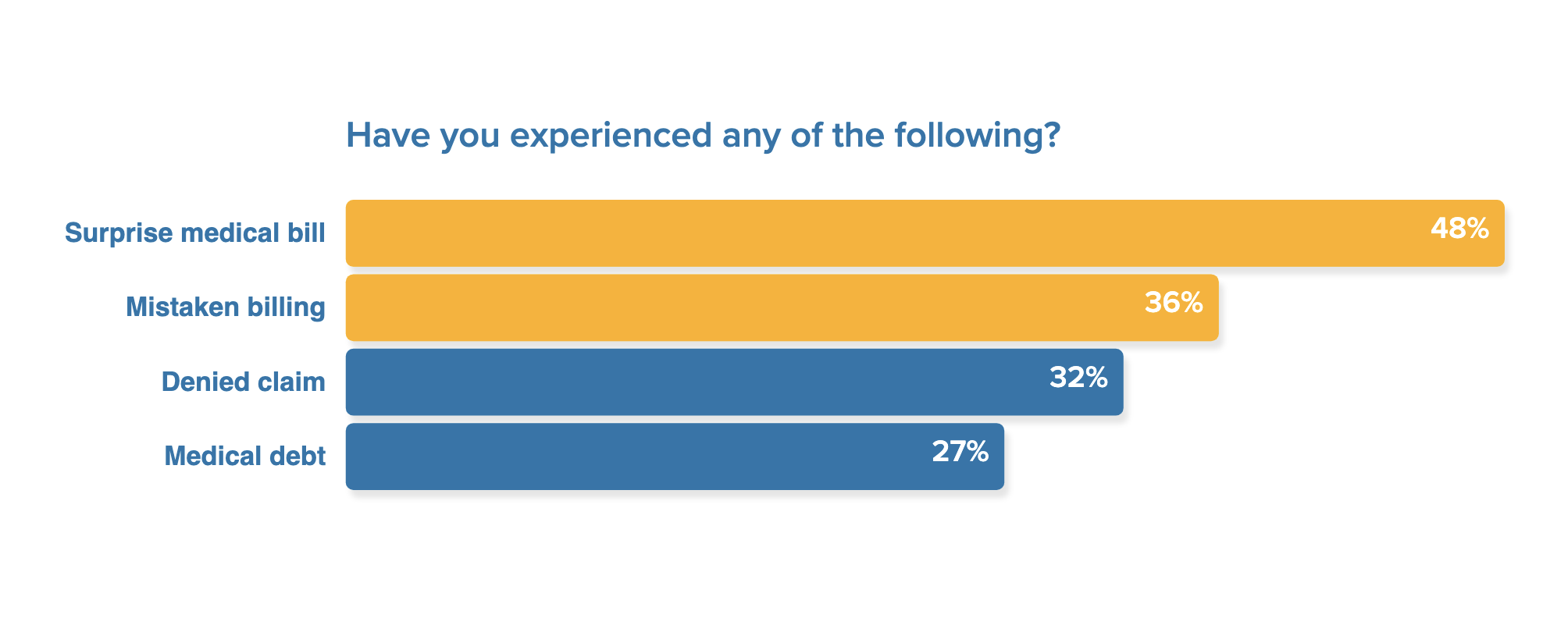

Many Americans are being driven into medical debt despite having health insurance.

- 44% say their plan didn’t cover the type of service received or they were out of network.

- 30% say their deductible was too steep and they couldn’t afford to pay.

- 18% say their coinsurance (the amount you pay after meeting your deductible) was too high.

- Just 8% say the hospital billed them incorrectly.

By medical service, respondents’ top source of debt were accidents/injuries that resulted, for example, in broken bones.

Accidents/injuries account for 17% of the healthcare that resulted in medical debt.

Dental, vision and hearing services, and chronic diseases like cancer were next at 15% each.

Human Costs of Debt

The human costs of Americans’ medical debt are significant.

- 22% of U.S. adults with medical debts skip food because their debts prevent them buying it

- 20% skip education

- 18% are prevented from paying their rent or mortgage

Meanwhile, 44% of respondents say medical debt harmed their credit score, and 42% say their bills have been sent to a debt collector.

Americans with medical debt don’t see a quick resolution to their struggles.

One in three (33%) think it will take longer than two years to pay off their debt.

In this environment, 37% are extremely or moderately concerned that medical debt will affect their financial health. A similar number, 33%, are extremely or much stressed by their debt.

Negotiating Tactics

Almost half of Americans with medical debt, 46%, say they tried to negotiate their debt.

The largest number spoke with their healthcare providers (31%).

21% negotiated with a debt collection agency, and 12% with their insurance company.

“Folks should understand their Explanation of Benefits and get everyone – bill collectors, insurance firms, and your doctor – on the same page,” says Jeff Smedsrud, cofounder of HealthCare.com and board member of RIP Medical Debt.

“Double check your statement for accuracy and remember you may be able to negotiate a discount.”

Debt Discounts Obtained Through Negotiation:

- 0%-20% discount – 22% of respondents

- 20%-40% discount – 10% of respondents

- 40%-60% discount – 9% of respondents

- 60%-80% discount – 3% of respondents

- 80%-100% discount – 2% of respondents

Over half (52%) of respondents said they would get the funds to pay their medical debts from their salary.

But 13% would borrow from friends or family, 12% would use retirement savings, and 10% would crowdfund online.

Methodology: HealthCare.com conducted this survey utilizing a SurveyMonkey Audience on October 29-November 1, 2021, among a national sample of 2,852 U.S. adults aged 18+. The modeled error estimate for this survey is plus or minus 2.0 percentage points. The sample was balanced for age, gender, and U.S. Region according to the Census Bureau’s American Community Survey.