What are ACA/Obamacare Plans?

The Affordable Care Act (ACA), known as Obamacare, was introduced in 2008 to reform health insurance. It established Health Insurance Marketplaces, making coverage easier to obtain and offering financial assistance for those who qualify.

ACA Plans are designed to increase accessibility and affordability for millions of Americans, including those self-employed or between jobs.

Key Features of ACA Plans:

- Marketplace: Enroll via HealthCare.gov or state-based Marketplaces to compare options.

- Pre-Existing Conditions: Coverage cannot be denied based on pre-existing conditions.

- Subsidies: Eligible individuals can receive tax credits to lower monthly premiums.

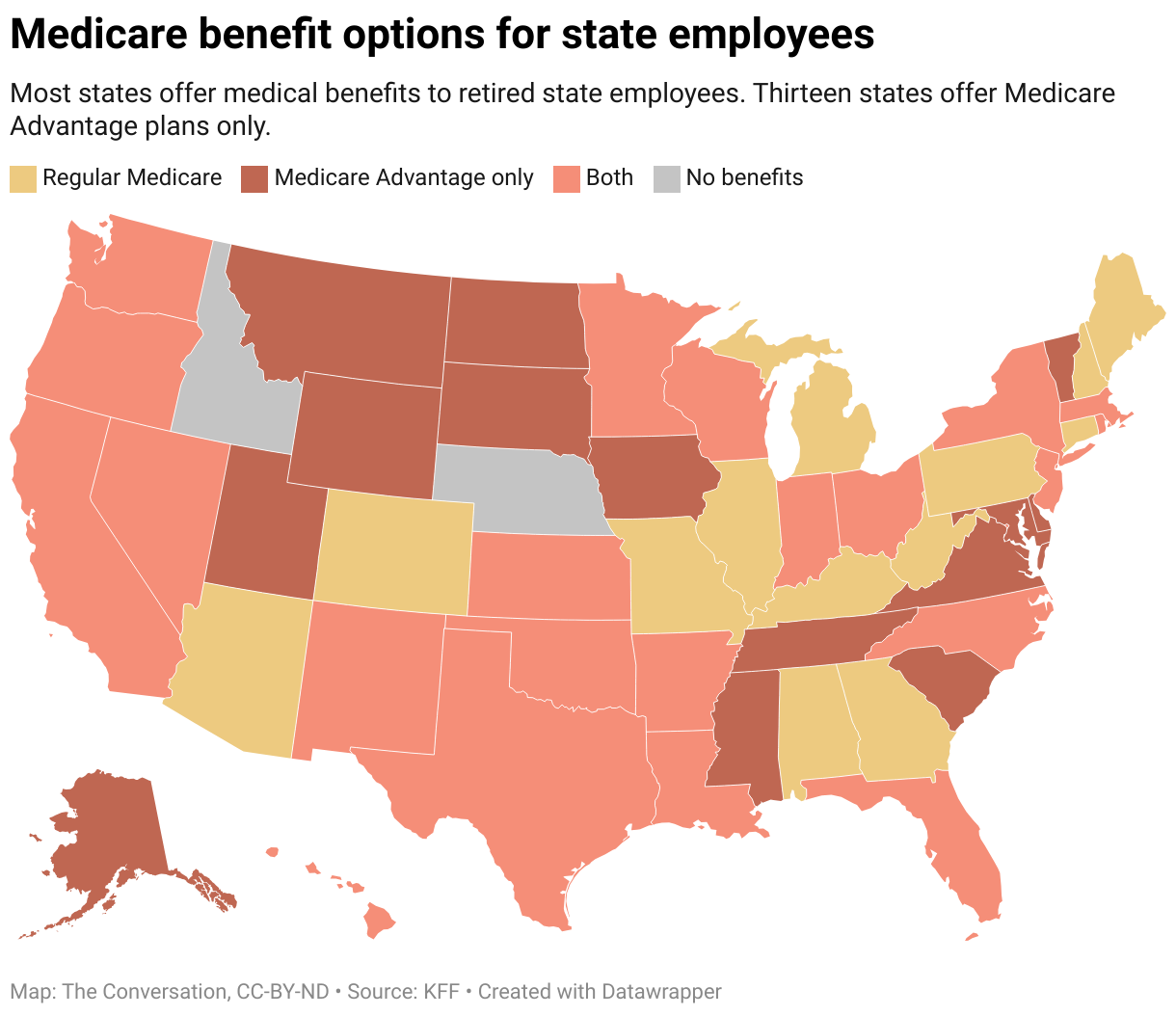

2024 ACA Premiums by State: A Snapshot of Average Costs After Subsidies

This dataset from KFF shows the average ACA premium after subsidy for various U.S. states in 2024, with premiums ranging from as low as $25 in Mississippi to $247 in New York. Overall, the national average is $74, indicating significant regional variation in health insurance costs.

Free Downloadable Guide

"*" indicates required fields

Eligibility: Available to U.S. citizens and legal immigrants through the Marketplace, with subsidies based on income.

- ACA coverage is available to U.S. citizens and legal immigrants. Plans are available to those without insurance from a job, Medicare, Medicaid, CHIP, or other qualifying sources.

- Are you Turning 26?

- As you age off your parents’ plan, consider buying an individual plan on the ACA Marketplace. If you’re self-employed, unemployed, or lack job-based coverage, you can explore various options through your state or the federal Marketplace at Healthcare.gov. When applying, you’ll find details on your eligibility for premium or cost-sharing subsidies and potential immediate Medicaid coverage.

Searching For Health Plans?

Explore ACA Plans By Carrier & Price

Plan Costs: Vary by metal tier, location, age, and insurer:

| Plan Category: | Plan pays: | You pay: | Deductible is generally: |

|---|---|---|---|

| Bronze | 60% | 40% | High |

| Silver | 70% | 30% | Moderate |

| Silver with extra savings | 73-96% | 6-27%(Depends how much savings you qualify for) | Low |

| Gold | 80% | 20% | Low |

| Platinum | 90% | 10% | Low |

How Can I Save on My Monthly Premiums?

Many qualify for plans for Subsidies, or Premium Tax Credits (PTC), or Advance Premium Tax Credits (APTC), which lower your monthly health insurance payments.

- In 2024, your eligibility is based on your projected income and the benchmark plan cost. You qualify for subsidies if you pay more than 8.5% of your household income towards health insurance.

- Next Steps: Check your eligibility using our ACA Subsidy Calculator, regardless of your income, to see your subsidy rate or consider switching plans.

What are the Coverage Benefits?

The Affordable Care Act (ACA) mandates that most health insurance plans cover 10 “essential health benefits,” including hospital services, prescription drugs, and maternity care. While these requirements primarily apply to marketplace and fully insured small group plans, many self-insured plans also adopt them. Before the ACA’s 2014 implementation, individual marketplace plans often excluded critical services like maternity and mental health care, leading to unexpected costs for consumers. The ACA also ensures coverage for individuals with preexisting conditions.

10 Essential Health Benefits

| Benefit | Description |

| Ambulatory patient services | This is the outpatient care, from doctor’s visits to same-day surgery, that you receive without being admitted to a hospital. |

| Emergency services | Insurance companies cannot charge you more for going to an out-of-network hospital’s emergency room in the case of a true emergency, such as a suspected heart attack or stroke,6 nor can they require prior approval for emergency room visits. |

| Hospitalization | This benefit includes surgery or other overnight, in-patient stays at a hospital. |

| Pregnancy, maternity, and newborn care | Insurance must cover medical services for you and your child, both before and after birth, as well as the cost of the delivery itself. Insurers must also cover birth control and breastfeeding services. |

| Mental health and substance use disorder services | Behavioral health treatment, such as counseling or psychotherapy, is a part of this benefit. |

| Prescription drugs | While insurers don’t cover all drugs, they must offer a formulary (approved list of medications) for which they’ll pay a portion of the costs.You can find a list of the medicines that your insurer covers by visiting its website. |

| Rehabilitative and habilitative services and devices | This benefit includes devices or services aimed at helping people with chronic conditions, disabilities, or injuries regain or improve skills. |

| Laboratory services | Coverage includes tests that doctors might run to aid in diagnosis. |

| Preventive and wellness services and chronic disease management | Preventive and wellness care covers routine doctor’s visits, such as annual exams and vaccinations. If you get preventive health services, such as a pap test, from an in-network provider, their services are free. However, not every service that you receive at a checkup is covered, so check your benefits before you go. |

| Pediatric services | In addition to the above preventive and wellness benefits, children’s benefits must include vision and dental care. |

When are the Open Enrollment Dates?

- November 1 – January 15

- Enroll by December 15 for coverage starting January 1.

- Enroll by January 15 for coverage starting February 1.

Can I Apply For a Plan Outside Open Enrollment?

If you experience a Qualifying Life Event (QLE), you can enroll in a health insurance plan outside the open enrollment period. QLEs grant a 60-day Special Enrollment Period (SEP) for selecting new coverage or changing existing plans.

Common QLEs include

- Marriage

- Divorce

- Having a baby

- Losing employer coverage

- Moving to a new ZIP code.

Your SEP begins the day of the event, and coverage typically starts the first day of the following month. If you don’t enroll within 60 days, you’ll have to wait for the next open enrollment period, but you may be eligible for temporary coverage in the meantime. Remember, using a SEP incurs no penalties, and insurers must accept your application just like during open enrollment.

Search For Health Plans In Your State

Explore options based on your needs and budget

How to Pay for Prescription Drugs

Health plans help cover certain prescription medications, with those on your plan’s formulary typically costing less.

Check Coverage:

- Visit your insurer’s website for a list of covered prescriptions.

- Review your Summary of Benefits and Coverage from your insurance company or Marketplace account.

- Call your insurer with your plan information, available on your insurance card or plan description.

If Your Prescription Isn’t Covered:

- Ask your insurer about a one-time refill for your medication after enrollment.

- You can initiate a drug exceptions process for non-covered prescriptions, usually requiring your doctor’s confirmation of necessity.

If Your Exception Is Approved:

- The drug will generally be treated as covered, with costs counting towards your deductible and out-of-pocket limits.

Denied Exception?

- You can appeal the decision for a review by an independent third party.

Pharmacy Options:

- Confirm whether your regular pharmacy is in-network for your new plan by contacting your insurer. Check for mail delivery options as well.

Health Insurance Terms Glossary

| Term | Description |

|---|---|

| Agent (broker) | A licensed individual or entity helping consumers select and enroll in health insurance plans, typically paid a commission percentage by the insurers. |

| Affordable Care Act (ACA) | Landmark health reform legislation passed in 2010, aiming to increase health insurance quality and affordability, lower the uninsured rate, and reduce healthcare costs. |

| Coinsurance | The percentage of costs a patient pays for a covered health care service after the deductible has been met. |

| Copayment | A fixed amount one pays for a covered health care service, usually when receiving the service. |

| Dependent | An individual, typically a spouse or child, covered by a primary insured person’s health insurance plan. |

| Deductible | The amount one pays for covered health care services before the insurance company starts to pay. |

| Federal poverty level (FPL) | A measure of income level issued annually by the Department of Health and Human Services (HHS), used to determine eligibility for specific programs and financial benefits. |

| Health Insurance Marketplace | Federal and state organizations that collectively form an “exchange” of health insurance plans that can be federally subsidized for more affordable rates. |

| High Deductible Health Plan (HDHP) | A plan with a higher deductible than a traditional insurance plan, usually with lower monthly premiums but higher out-of-pocket costs. |

| Health Maintenance Organization (HMO) | A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. |

| In-network coinsurance | The percentage of costs one pays for covered health care services within the provider network. |

| In-network copayment | A fixed amount one pays for covered health care services from providers within the network. |

| Medical underwriting | A process insurance companies use to determine a person’s health status when applying for health insurance coverage. |

| Marketplace | An online organization operated by federal or state governments where one can shop for, compare, and buy health insurance. |

| Medicaid | A state program that receives federal dollars to provide health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. |

| Network | The facilities, providers, and suppliers your health insurer has contracted with to provide health care services. |

| Obamacare | Colloquial term for the Affordable Care Act (ACA), a comprehensive healthcare reform signed into law by President Obama in 2010. |

| Open Enrollment Period | The yearly period when people can enroll in a health insurance plan; outside this period, one needs a special circumstance to qualify for enrollment. This period is November 1 – January 15 annually. |

| Out-of-network coinsurance | The percentage of costs one pays for covered health care services outside the provider network. |

| Out-of-pocket maximum/limit | The most you must pay for covered services in a plan year; after this amount, your health insurance company pays 100% of covered benefits. |

| Out-of-pocket costs | Expenses for medical care that aren’t the responsibility of the insurance company, including deductibles, coinsurance, and copayments for covered services, plus all costs for non-covered services. |

| Out-of-network copayment | A fixed amount one pays for covered healthcare services from providers outside the network. |

| Pre-existing condition | A health problem, like asthma, diabetes, or cancer, that existed before the date that new health coverage starts. |

| Preferred Provider Organization (PPO) | A type of health plan that contracts with medical providers to create a network of participating providers; you pay less if using network providers. |

| Premium | The amount that must be paid for health insurance or a plan, usually paid monthly by you and/or your employer. |

| Premium tax credit | A tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Marketplace. |

| Qualifying Life Events (QLE) | Certain life events that allow enrollment in health insurance outside the Open Enrollment Period. |

| Subsidy | Financial assistance that helps pay for health insurance coverage, lowering monthly costs. |